Score founders before you invest. Monitor them after.

Uncover red flags, validate track records, reveal network strength—in 30 seconds

The factor that matters most is evaluated least rigorously.

Your tech stack covers deal sourcing, market research, and portfolio management. But team assessment? Still gut feel and reference calls.

Card 1 — Signal Overload

2,000+ decks per year. 50 first meetings. You're making million-dollar decisions on pattern matching and warm intros.

Card 2 — Reference Theater

LinkedIn profiles curated, pitchdecks polished, credentials exaggerated. Failures buried, redflags missed

Card 3 — Invisible Risk

OSINT-powered verification – failed ventures, news archives, digital footprints – you won't find until it's too late

Card 4 — Portfolio Blind Spots

50-75 founders across a fund lifecycle. Who's monitoring them consistently? Nobody.

"VCs attribute success or failure more to the team than to the business itself."— Gompers et al., Journal of Financial Economics (885 VCs surveyed)

Systematic leadership intelligence, built for how you actually invest.

TeamDueDil uses AI agents to surface what reference calls miss—scored founder profiles with nuanced risk assessment across dozens of public sources.

Founder Credibility Scoring

Experience, network quality, execution history, reputation, and + Founder selection defensible to LPs

Easy to use

Potential integration with popular tools for pitchdeck intake

Team Composition Analysis

Complementarity assessment, diversity scoring, cohesion factors. See if the team is built to win—or built to fracture.

Continuous Portfolio Monitoring

Every founder in your portfolio, monitored 24/7. Abnormal public activities, reputation shifts, network movements—flagged before they escalate.

From Data to Decisions in Seconds

See the complete dashboard in action—comprehensive team analytics, detailed individual profiles, and actionable intelligence at your fingertips. Everything you need to make confident investment decisions, delivered instantly.

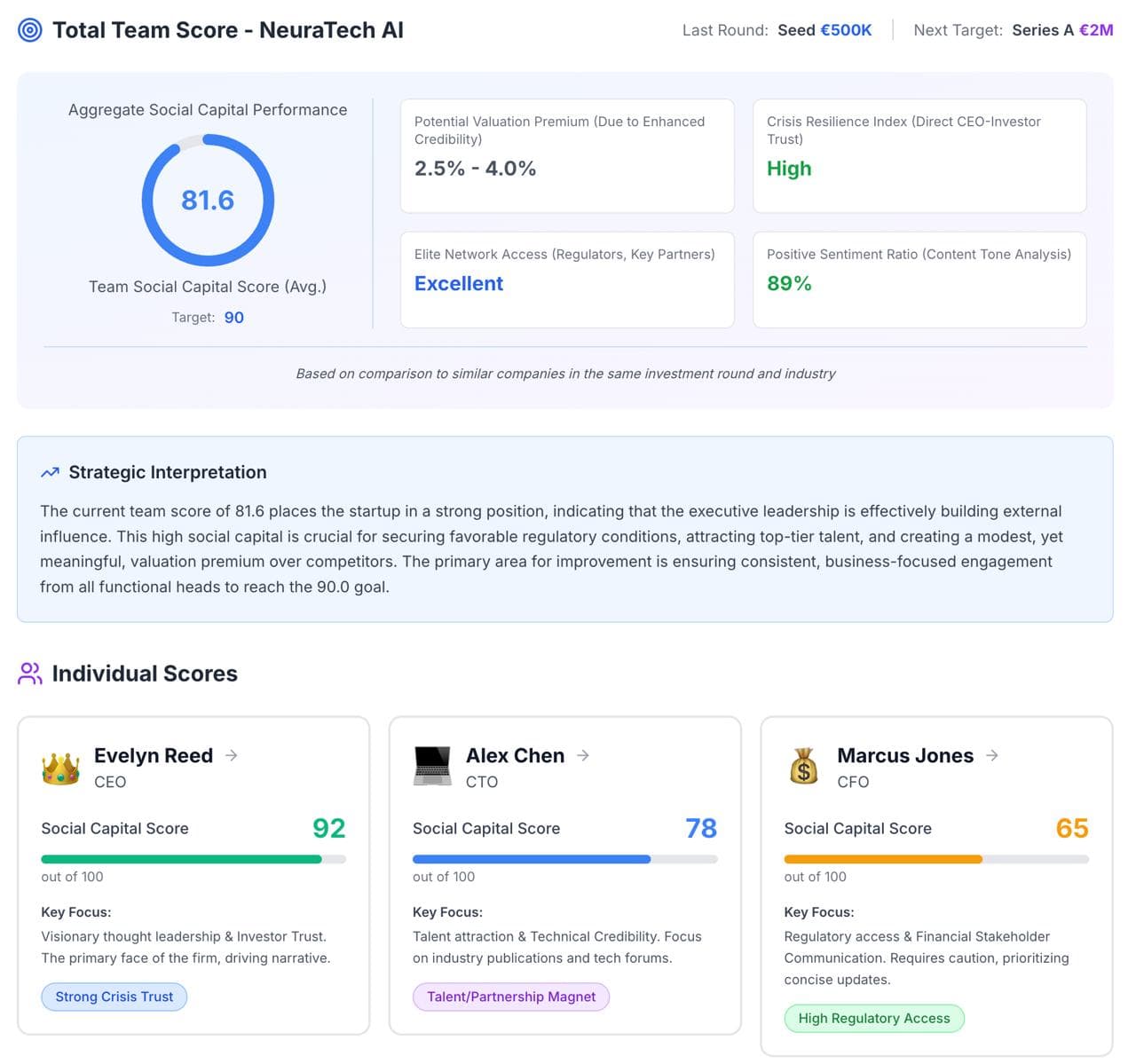

Team Social Capital Analysis

Aggregate team scores, key metrics, and individual breakdowns

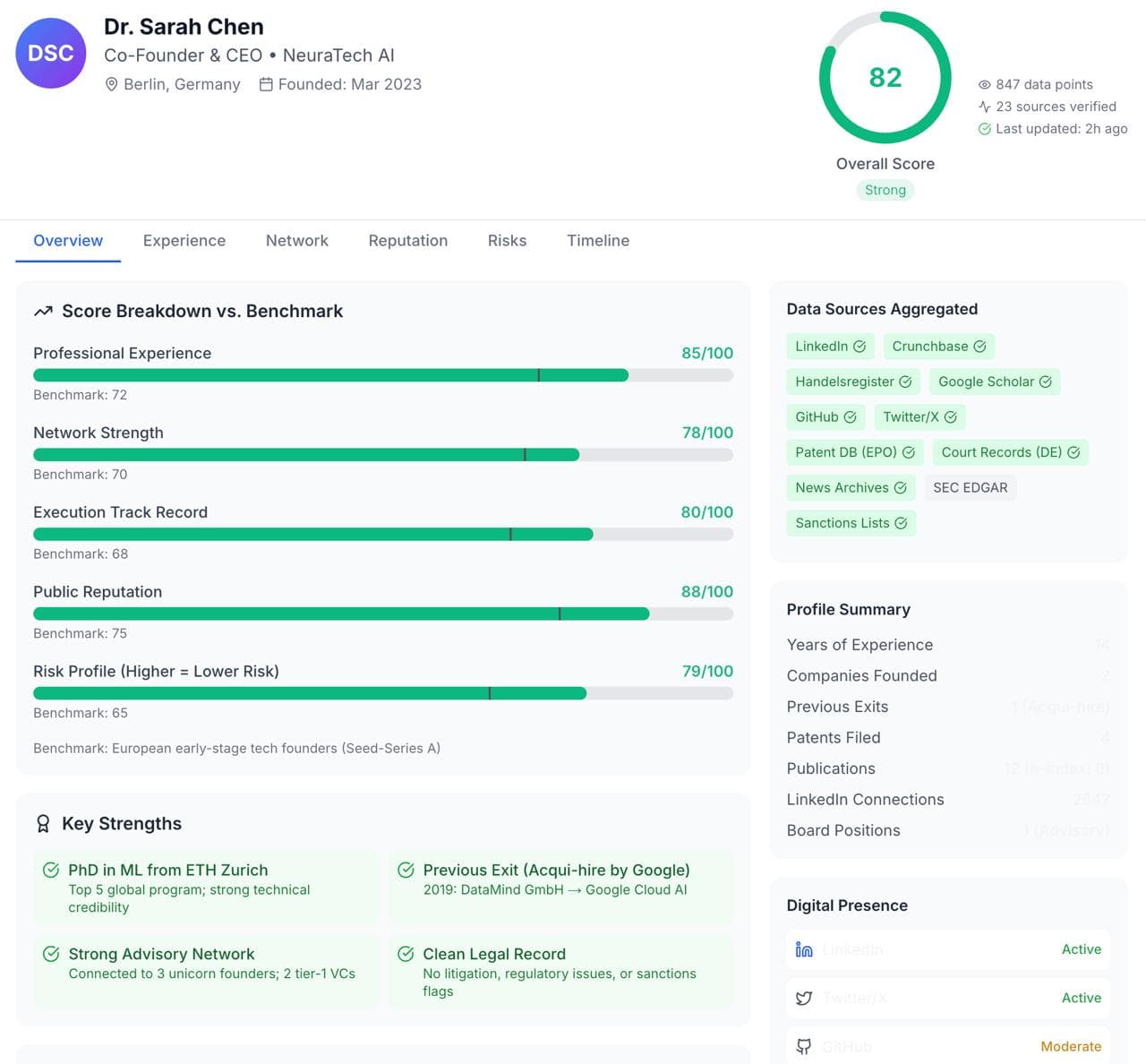

Individual Founder Profile

Deep-dive into experience, network, reputation, and risk factors

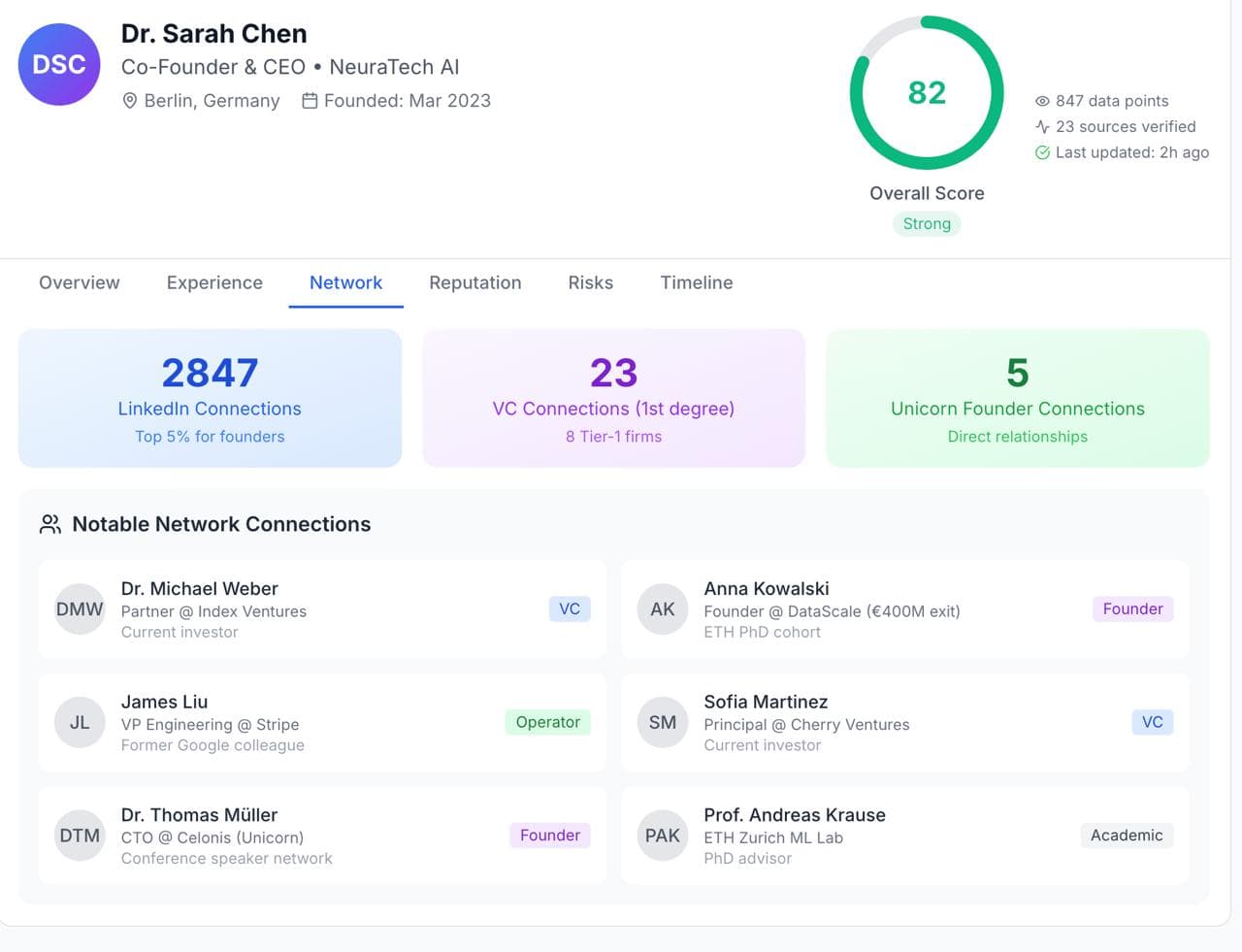

Network & Connections

Visualize professional networks, key relationships, and influence

Enter your email to receive instant access to these interactive demos.

From deck to decision in minutes, not weeks.

Ingest

Connect your deal flow. We pull founder data automatically when a deck arrives.

Analyze

AI agents scan 50-100 OSINT sources: corporate registries, court records, patents, publications, social profiles, news archives.

Score

Receive investment-grade leadership profiles with explainable scores, red flags, green flags, and peer comparisons.

Monitor

For portfolio companies, continuous surveillance with instant alerts on material changes.

We don’t replace your intuition. We reduce your risks.

| What You Use Now | The Problem | TeamDueDil Advantage |

|---|---|---|

| Reference Calls | Hand-picked, biased, slow | Multiple sources, unbiased, instant |

| Background Checks | Pass/fail binary, no insight | Scored profiles, nuanced, actionable |

| Deal Platforms | Company data only | Leader-centric, fills the gap |

Investment-Grade

Built for institutional investors, not HR

OSINT-Native

AI agents designed for intelligence aggregation

CEE Expertise

Multi-language coverage where others can't reach

Full Lifecycle

Pre-investment screening + post-investment monitoring

Wherever leadership quality drives returns.

VC / PE Funds

Screen faster. Diligence deeper. Document your process for LPs.

Family Offices

Direct investments demand direct intelligence. Know who you're backing.

Corporate Venture

Strategic bets require strategic clarity on the people behind the pitch.

Commercial Banks

SME credit underwriting, leveraged finance, M&A advisory—leadership risk is credit risk.

Stop guessing. Start measuring.

We're looking for early design partners—funds willing to shape the product while getting first access to systematic leadership intelligence.